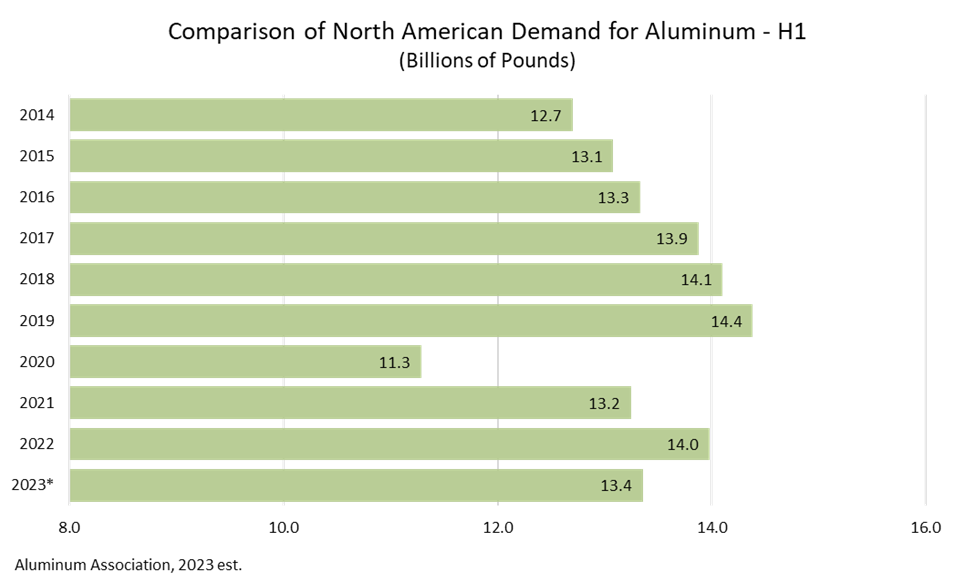

Domestic Aluminum Demand Down 4.5% Through First Half of Year

2023 Demand Remains Above 10-Year Average as U.S. Investments Continue

As part of its monthly Aluminum Situation report, the Aluminum Association released preliminary estimates showing demand for the aluminum industry in North America (U.S. and Canada) declining 4.5% through the first half of 2023.

“While aluminum demand has declined in the first half of 2023 following a buoyant 2022, it remains relatively strong compared to the past decade,” said Charles Johnson, president & CEO of the Aluminum Association. “Projects to build new, U.S.-based aluminum rolling mills for the first time in decades are underway as the long-term industry outlook is quite strong.”

Among key takeaways from the report:

- Aluminum demand in the United States and Canada (shipments by domestic producers plus imports) totaled an estimated 13.3 million pounds in the first quarter compared to 13.9 million in the first half of 2022.

- Electrical wire & cable saw 13.1% year-over-year demand growth in the first half as the electrical infrastructure market remains strong.

- In total, semi-fabricated – or “mill” – product demand was off 9.4% year-over-year through Q2.

- Aluminum exports (excluding scrap) to foreign countries increased 23.4% in the half.

- At 107.20, the Association’s Index of Net New Orders of Aluminum Mill Products (baseline index of 100) has shown a decline of 8.1% year-to-date.

- Imported aluminum and aluminum products into the North America (US and Canada) have fallen nearly 19% through the first half of the year.

Since 2021, Aluminum Association member companies have announced nearly $6 billion in domestic manufacturing operations ($9 billion over the last decade) – including new, U.S.-based greenfield facilities for the first time since the 1980s. Aluminum is growing thanks to increased demand for sustainable packaging, safe and efficient vehicles, greener buildings and vital infrastructure.

The Aluminum Situation report is one of more than two-dozen ongoing industry statistical reports developed exclusively by the Aluminum Association through surveys of aluminum producers, fabricators and recyclers. Subscribers to the Aluminum Association statistical reports have access to an online portal with data users can manipulate directly to produce interactive, presentation-ready charts and graphs.

To learn more about the Aluminum Association’s statistical offerings or to subscribe, visit www.aluminum.org/statistics.