STUDY: Demand for Aluminum in Residential Building & Construction Likely to Grow 50% by Mid-Decade

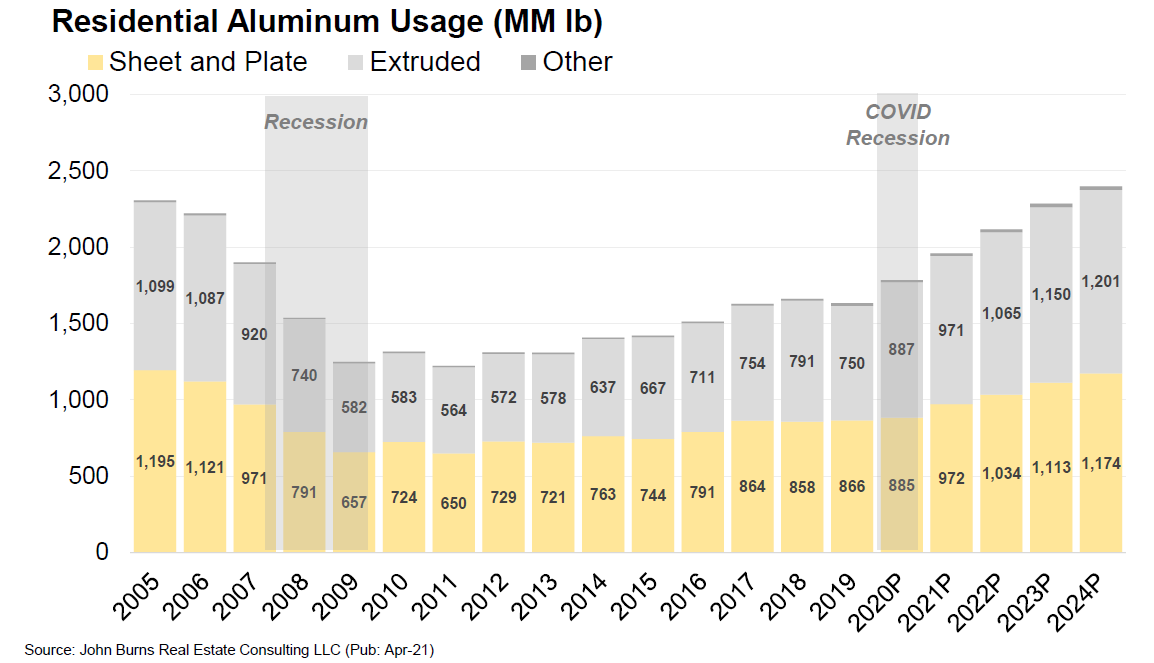

Analysis by John Burns Real Estate Consulting Projects 8% CAGR; Surpass Mid-2000s Usage by 2024

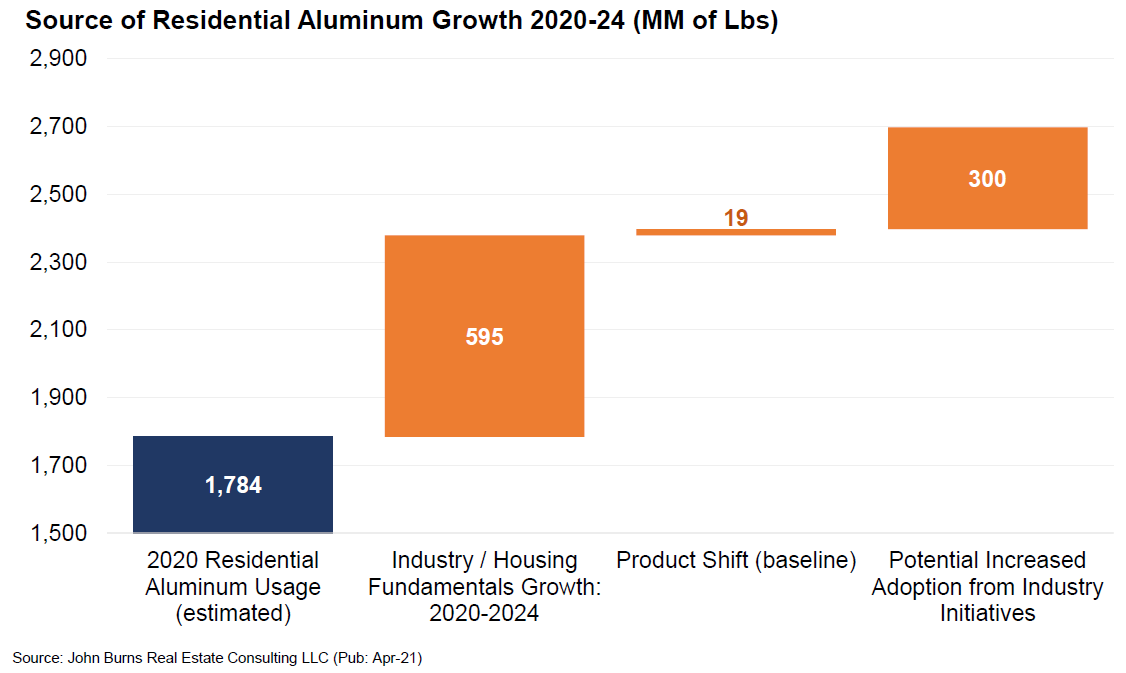

A market study by John Burns Real Estate Consulting (JBREC) projects that aluminum usage will grow by 34% - 51% in the residential building and construction market by 2024. This would surpass record shipment levels last seen in the early-to-mid 2000s. Per the analysis, the growth will be driven by strong demand in the U.S. housing market along with a growing trend of builders and consumers alike choosing aluminum as a premium material in building construction.

The JBREC study, which was finalized in 2021, made three major conclusions:

- Building Aluminum Market Expected to Grow at 8% Compound Annual Growth Rate (CAGR): Demand in residential building and construction is expected to surpass mid-2000s record levels by 2024.

- Design Shifts to Add 154 Million Pounds of New Aluminum Usage by Mid-Decade: A shift toward modern design in SURBAN living environments (redeveloped suburban areas with urban amenities) will drive additional demand growth.

- Significant Further Upside for Building Aluminum Possible: The study projected an additional 300 million pounds of aluminum use in the market by 2025 in its upside case, driven partially by increased use of aluminum gutters and downspouts.

“Aluminum is the smart choice for home builders and owners. Lightweight and durable, aluminum can reduce building and maintenance costs over the lifetime of a home,” said Laura Lanza, Sales Director of Building and Construction Products for Novelis, and chair of the Aluminum Association’s Building & Construction Committee. “As post-COVID economic recovery continues, aluminum has an incredible runway in this market and we look forward to being a part of it.”

Four prevailing trends in the building and construction market are driving the shift toward higher aluminum use:

- Shift Toward SURBAN Living and Contemporary Commercial Projects: The shift toward higher density living and low-maintenance modern design will drive demand for aluminum cladding, windows and doors.

- Modular Construction and Increased Use of Accessory Dwelling Units: The move toward modular construction techniques will drive the use of the metal.

- Aluminum Substitution for Vinyl: The value proposition of aluminum’s durability and consumer preference for premium, environmentally friendly products will support a shift away from vinyl options.

- Wave of Aging Roofing by 2025: Aluminum roofing is projected to grow faster than asphalt as a wave of roof replacements from early 2000s housing boom crests.

“Beyond these consumer trends, the recently passed bipartisan Infrastructure Investment & Jobs Act will act as a demand well for aluminum in the building and construction market well into the 2020s,” said Charles Johnson, president & CEO of the Aluminum Association. “According to our analysis, approximately $400 billion of the spending in the bill has the potential to directly impact aluminum usage in the United States.”

Aluminum’s use in the building and construction market was pioneered less than a century ago with the construction of the Empire State Building in New York City. Since then, the metal has become ubiquitous in building for both residential and commercial applications thanks to its lightweight durability and recyclability. Aluminum can be used in a building for upward of 75 years before being recycled and repurposed for future applications. Aluminum used in building and construction enjoys high levels of recycled content, 95%+ end of life recycling rates and consequently a low carbon footprint compared to many competitor materials.

The Aluminum Association is committed to supporting the growth of the building and construction market through credible data and information. The Aluminum Association’s Environmental Product Declarations (EPDs) and Aluminum Green Building Guides provide technical data to help builders to achieve Leadership in Energy & Environmental Design (LEED) and similar certifications.

In 2021, the Aluminum Association launched the Choose Aluminum campaign to highlight how the aluminum industry supports sustainable development in the U.S. and around the world. Last spring, the association released the U.S. Aluminum Industry Sector Snapshot showing positive environmental trendlines for the U.S. industry on virtually every measure since the 1990s – a period when aluminum demand grew by 25%. This year, the association released a new life cycle assessment (LCA) report showing that the carbon footprint of aluminum production in North America declined by more than half over the past 30 years.